Here Are The Cash Flows For Two Mutually Exclusive Projects 45+ Pages Summary in Google Sheet [550kb] - Updated 2021

Get 31+ pages here are the cash flows for two mutually exclusive projects answer in PDF format. A -20000 8000 8000 8000. At what interest rates would you prefer project a to b. What is the NPV if the opportunity cost of capital is 4. Check also: here and here are the cash flows for two mutually exclusive projects Project C 0 C 1 C 2 C 3.

Expected Cash flows for Two mutually exclusive investments. Try drawing the NPV profile of each project.

Answered 28 A Pany Is Considering Two Bartle Project C0 C1 C2 C3 A 20000 8000 8000 8000.

| Topic: Here Are The Cash Flows For Two Mutually Exclusive Projects. Answered 28 A Pany Is Considering Two Bartle Here Are The Cash Flows For Two Mutually Exclusive Projects |

| Content: Explanation |

| File Format: PDF |

| File size: 800kb |

| Number of Pages: 11+ pages |

| Publication Date: August 2021 |

| Open Answered 28 A Pany Is Considering Two Bartle |

|

Here are the cash flow forecasts for two mutually exclusive projects.

Solution for Here are the cash-flow forecasts for two mutually exclusive projects. Here are the cash flows for two mutually exclusive projects. 0 115 115. Here are the cash-flow forecasts for two mutually exclusive projects. 19We can find the IRR of Project A and Project B is 9 and 8 respectively please see the calculation in excel in attachment So if the interest rate below 8 then Project A is more profitable than project B. Which project would you choose using the NPV method if the discount rate is 4.

Project Cash Flow N A B Example 1 Consider The Following Two Mutually Exclusive Investment Projects Assume Ppt Video Online Download Here are the cash flows for two mutually exclusive projects.

| Topic: Here are the cash flows for two mutually exclusive projects. Project Cash Flow N A B Example 1 Consider The Following Two Mutually Exclusive Investment Projects Assume Ppt Video Online Download Here Are The Cash Flows For Two Mutually Exclusive Projects |

| Content: Explanation |

| File Format: Google Sheet |

| File size: 3mb |

| Number of Pages: 21+ pages |

| Publication Date: November 2021 |

| Open Project Cash Flow N A B Example 1 Consider The Following Two Mutually Exclusive Investment Projects Assume Ppt Video Online Download |

|

Here Are The Cash Flows For Two Mutually Exclusive Chegg Project C1 C2 C3 -20000.

| Topic: Here are the cash flow forecasts for two mutually exclusive projects. Here Are The Cash Flows For Two Mutually Exclusive Chegg Here Are The Cash Flows For Two Mutually Exclusive Projects |

| Content: Synopsis |

| File Format: DOC |

| File size: 6mb |

| Number of Pages: 55+ pages |

| Publication Date: January 2021 |

| Open Here Are The Cash Flows For Two Mutually Exclusive Chegg |

|

Paring Mutually Exclusive Projects With Unequal Lives You can find NPV of each project follow the decrease in interest rate in the excel attached.

| Topic: Here Are The Cash Flows For Two Mutually Exclusive Projects. Paring Mutually Exclusive Projects With Unequal Lives Here Are The Cash Flows For Two Mutually Exclusive Projects |

| Content: Analysis |

| File Format: PDF |

| File size: 2.6mb |

| Number of Pages: 6+ pages |

| Publication Date: April 2018 |

| Open Paring Mutually Exclusive Projects With Unequal Lives |

|

4 Two Mutually Exclusive Projects Have Projected Cash Flows As Follows End Of Year 0 Project A 2 000 1 000 1 000 1 000 1 000 Project B 2 000 0 0 6 000 A Determine The Internal Rate Of Return F Homeworklib Here are the cash flows for two mutually exclusive projects.

| Topic: Year Project A Project B 0 -280 -430 1 -387 134 2 -193 134 3 -100 134 4. 4 Two Mutually Exclusive Projects Have Projected Cash Flows As Follows End Of Year 0 Project A 2 000 1 000 1 000 1 000 1 000 Project B 2 000 0 0 6 000 A Determine The Internal Rate Of Return F Homeworklib Here Are The Cash Flows For Two Mutually Exclusive Projects |

| Content: Summary |

| File Format: DOC |

| File size: 1.8mb |

| Number of Pages: 21+ pages |

| Publication Date: October 2018 |

| Open 4 Two Mutually Exclusive Projects Have Projected Cash Flows As Follows End Of Year 0 Project A 2 000 1 000 1 000 1 000 1 000 Project B 2 000 0 0 6 000 A Determine The Internal Rate Of Return F Homeworklib |

|

Capital Budgeting Techniques Binam Ghimire 1 Objectives Do not round intermediate calculations.

| Topic: Here Are The Cash Flow Forecasts For Two Mutually Exclusive Projects. Capital Budgeting Techniques Binam Ghimire 1 Objectives Here Are The Cash Flows For Two Mutually Exclusive Projects |

| Content: Answer Sheet |

| File Format: PDF |

| File size: 2.8mb |

| Number of Pages: 35+ pages |

| Publication Date: October 2019 |

| Open Capital Budgeting Techniques Binam Ghimire 1 Objectives |

|

Question 4 As The Director Of Capital Budgeting For Chegg Calculate the projects net present value for discount rates of 0 50 and 100.

| Topic: Cash Flows dollars Year Project A Project B 0 -119 -119 1 49 68 2 69 68 3 89 68 a-1. Question 4 As The Director Of Capital Budgeting For Chegg Here Are The Cash Flows For Two Mutually Exclusive Projects |

| Content: Learning Guide |

| File Format: PDF |

| File size: 1.9mb |

| Number of Pages: 29+ pages |

| Publication Date: December 2019 |

| Open Question 4 As The Director Of Capital Budgeting For Chegg |

|

Doc Homework4 With Ans J Madina Nurzhigitova Academia Edu LO8-1 and LO8-2 Project C0 C1 C2 C3 A-20000 8000 8000 8000 B-20000 0 0 25000 a.

| Topic: Which project would you choose using the NPV method if the discount rate is 4. Doc Homework4 With Ans J Madina Nurzhigitova Academia Edu Here Are The Cash Flows For Two Mutually Exclusive Projects |

| Content: Solution |

| File Format: Google Sheet |

| File size: 2.8mb |

| Number of Pages: 21+ pages |

| Publication Date: January 2019 |

| Open Doc Homework4 With Ans J Madina Nurzhigitova Academia Edu |

|

As The Capital Budgeting Director For Denver Chegg Here are the cash flows for two mutually exclusive projects.

| Topic: Solution for Here are the cash-flow forecasts for two mutually exclusive projects. As The Capital Budgeting Director For Denver Chegg Here Are The Cash Flows For Two Mutually Exclusive Projects |

| Content: Summary |

| File Format: Google Sheet |

| File size: 1.5mb |

| Number of Pages: 27+ pages |

| Publication Date: April 2019 |

| Open As The Capital Budgeting Director For Denver Chegg |

|

Capital Budgeting For 9 220 Term 1 200203

| Topic: Capital Budgeting For 9 220 Term 1 200203 Here Are The Cash Flows For Two Mutually Exclusive Projects |

| Content: Learning Guide |

| File Format: PDF |

| File size: 2.2mb |

| Number of Pages: 6+ pages |

| Publication Date: November 2017 |

| Open Capital Budgeting For 9 220 Term 1 200203 |

|

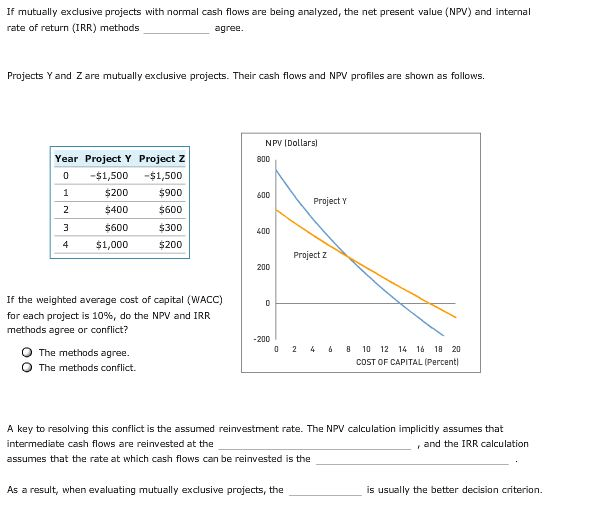

Solved If Mutually Exclusive Projects With Normal Cash Flows Are Being 1 Answer Transtutors

| Topic: Solved If Mutually Exclusive Projects With Normal Cash Flows Are Being 1 Answer Transtutors Here Are The Cash Flows For Two Mutually Exclusive Projects |

| Content: Synopsis |

| File Format: DOC |

| File size: 6mb |

| Number of Pages: 4+ pages |

| Publication Date: February 2019 |

| Open Solved If Mutually Exclusive Projects With Normal Cash Flows Are Being 1 Answer Transtutors |

|

Psb Tutorial Solutions Week 2 Internal Rate Of Return Present Value

| Topic: Psb Tutorial Solutions Week 2 Internal Rate Of Return Present Value Here Are The Cash Flows For Two Mutually Exclusive Projects |

| Content: Analysis |

| File Format: Google Sheet |

| File size: 1.4mb |

| Number of Pages: 13+ pages |

| Publication Date: December 2018 |

| Open Psb Tutorial Solutions Week 2 Internal Rate Of Return Present Value |

|

Its definitely easy to prepare for here are the cash flows for two mutually exclusive projects As the capital budgeting director for denver chegg project cash flow n a b example 1 consider the following two mutually exclusive investment projects assume ppt video online download capital budgeting for 9 220 term 1 200203 capital budgeting techniques binam ghimire 1 objectives paring mutually exclusive projects with unequal lives psb tutorial solutions week 2 internal rate of return present value answered 28 a pany is considering two bartle question 4 as the director of capital budgeting for chegg

Post a Comment

Post a Comment